Are you one of those people who say magulo isip nila at walang mangyari? Let me help you by guessing some probable reasons.. 1. Hindi mo alam ang gusto mo. Siguro natatakot kang magkamali. O hindi ka nasanay ng nagdedecide kahit may takot na baka mali? Walang perfect decision. Mas mahirap kung walang decision and…

Read More

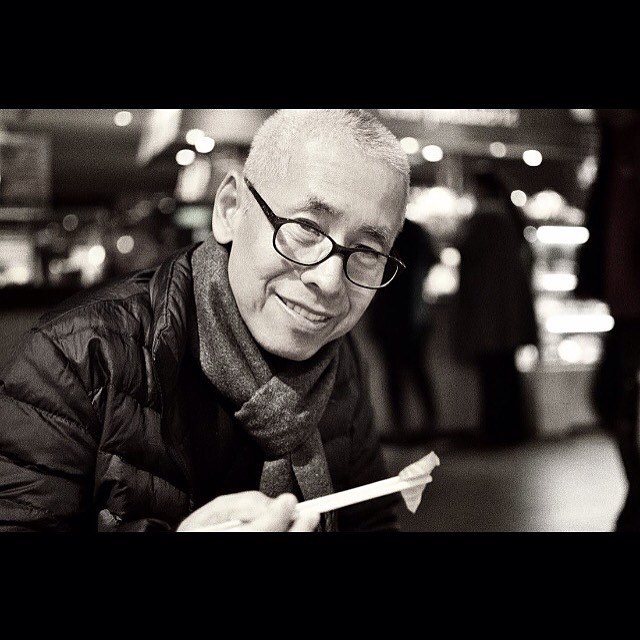

About

Boni de Jesus is a financial consultant and president of LTL Consultants, a financial consultancy company. For over 3 decades, Boni has been helping businesses grow by providing business advice and helping companies access funding. Having seen how businesses and business owners prosper and how other businesses fail, he has accumulated a lot of insight…

Read More